What Happens When Eviction Moratoriums Expire?

Among the economic and social problems exacerbated by the coronavirus is growing housing insecurity in the United States. At the beginning of the pandemic, most states enacted temporary legislation to prevent or postpone evictions and foreclosures—now, however, several of these bans have recently expired. A backlog of old cases, along with new ones from unpaid rent and mortgage payments since April, may lead to a surge in evictions and foreclosures affecting millions of Americans.

What is the current situation for renters, homeowners, and landlords? What options and tools are available? Below, we answer these questions and link out to resources where you can learn more.

What is the current status of eviction and foreclosure moratoriums in the United States?

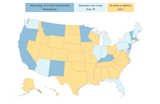

Overall, some form of a moratorium remains active in nearly two dozen U.S. states, with some—including New York and New Jersey—indefinitely extending the ban until the state’s COVID-19 emergency declaration is over as well. On July 1, bans expired in several states—including Indiana and New Hampshire—adding to the the bans that expired in Alabama, Mississippi, Louisiana, North Carolina, Hawaii, Alaska, and a few others in June. Pennsylvania, Michigan, Arizona, and Illinois all have legislation set to expire before the end of July.

Federal protection for renters provided by the 2020 Coronavirus Aid, Relief, and Economic Security (CARES) Act is also set to expire on July 25th unless extended. Providing protection beyond this date, several states, including Connecticut, Nevada, and Oregon, have officially extended eviction bans into August or September. The online legal assistance website NOLO is maintaining a list of dates and links to both state and federal legislation.

How is the situation affecting renters and homeowners?

The U.S. Federal Housing Finance Agency (FHFA) recently extended a moratorium on evictions and foreclosures for federally backed mortgages through August 31st, which covers both renters and homeowners living in a property financed with such a mortgage. Yet, protections do not apply to private mortgages or properties that are owned outright. Most major banks are also offering forbearance payment plans for mortgage holders needing to delay payments.

Researchers and housing organizations worry about the surge in eviction filings that is expected as courts reopen. A recent study by researchers at the Massachusetts Institute of Technology (MIT) shows that eviction filings in Boston—which are currently on hold—largely affect majority non-white neighborhoods.

Another resource from the Eviction Lab at Princeton University provides a historical overview of evictions, as well as a COVID-19 scorecard for every state that compiles information from state-by-state emergency orders, declarations, and legislation. Connecticut currently holds the highest rating of 4.28 out of 5 stars, taking into account how evictions are initiated, short-term supports (such as rent payment grace periods), court process, tenancy preservation measures (such as no late fees), and eviction enforcement. Other states—Alabama, Arkansas, Kansas, Louisiana, Missouri, Nebraska, South Dakota, Tennessee, and Texas—have received a score of 0.

Eviction Lab and Columbia Law School professor Emily Benfer has developed a scorecard ranking states by their efforts to ensure stabling housing during the pandemic. Connecticut, summarized in this outline, scores 4.28 out of 5.

In North Carolina, where the moratorium ended on June 21st, advocates also worry about the public health effects. "My fear is if tens of thousands of North Carolina families are facing homelessness due to these evictions, that is certainly not going to help us get the spread of this disease under control," Samuel Gunter, executive director of the North Carolina Housing Coalition, told The News & Observer. "We know that stay-at-home orders and social distancing are essential to stemming the pandemic."

What about landlords?

Unpaid rent is also causing hardship for landlords, particularly private individuals who rely on rental income for their own livelihood. Some landlords, big and small, have come out against the moratoriums, including those who filed a lawsuit last week in response to the City of San Francisco's permanent ordinance preventing COVID-related evictions from nonpayment of rent. A separate group of landlords and associates sued the City of Los Angeles in June.

Some states and cities are also providing relief to landlords affected by reduced income during the current pandemic. New York and several other states are providing assistance to landlords as part of their COVID-19 small business loan funds. For other resources, check out this state-by-state list and this guide to landlord's rights.

What options and resources are available?

If you are a renter, there are many resources for learning more about your situation and rights. For example, ProPublica offers an interactive online tool for searching your address to see if the property is backed by a federal mortgage, in which case the extended FHFA regulations apply until August 31st. The U.S. Consumer Financial Protection Bureau explains these protections and others in more detail.

New York State Homes and Community Renewal (HCR), the state’s affordable housing agency, has a COVID Rent Relief Program that gives eligible households a one-time rental subsidy. The application period ends on July 30, and recipients will be chosen based on income, rent, income loss, and risk of homelessness.

An interactive tool at ProPublica.org allows you to search for your property address and learn about the eviction process in your state.

What happens next?

While the COVID-19 situation is still uncertain in general, many states are bracing for higher rates of evictions and considering what kind of support may be needed. The director of the Louisiana Fair Housing Action Center, Cashauna Hill, told ABC News, "We're really concerned that we're going to see an avalanche of evictions as the courts open back up." Peter Gilbert, an attorney at Legal Aid of North Carolina, agreed: "July and August are always months that have very high filings, but I think that we may see an enormous wave of filings over the next few months."

To offset and possibly prevent such increases, several states—including Indiana and Michigan—are using federal funds from the CARES Act to establish new rental assistance funds. Renters who are unable to pay all or part of their rent due to coronavirus-related job losses or a reductions in income may be eligible for temporary assistance. More resources and information can be found at the U.S. Department of Housing and Urban Development website.

Related Reading:

Here’s What You Should Know About Rent Relief During the Pandemic

How to Get Mortgage Relief if Your Income Is Affected by the Coronavirus Pandemic

Published

Last Updated

Topics

New NormalGet the Dwell Newsletter

Be the first to see our latest home tours, design news, and more.